Overview of Banclo Loan Request States and Navigation

Banclo specializes in managing loan requests, which progress through the following stages:

Loan Request States in Banclo

- PRE BID

The PRE BID state is the initial phase where the loan request is prepared but not yet visible to the bank. During this stage, the client is responsible for completing specific tasks, such as providing necessary documentation, filling out forms, or meeting certain pre-qualification criteria. The loan request remains in this state until all required tasks are fulfilled, making it ready for the next stage.

- BID

In the BID state, the loan request becomes visible to the bank. This stage involves the bank reviewing the submitted application and offering terms or conditions under which they are willing to provide the loan. Multiple banks or financial institutions may compete to offer the best terms to the client, who can then choose the most favorable bid.

- PRE SANCTIONING

After a bid is accepted, the loan request moves to the PRE SANCTIONING stage. During this phase, preliminary checks and verifications are conducted by the bank. This includes assessing the client's creditworthiness, evaluating collateral, and performing due diligence. The aim is to ensure that the client meets all the necessary conditions before the loan can be sanctioned.

- SANCTIONING

The SANCTIONING stage is where the loan is formally approved. The bank finalizes the terms and conditions, and the loan agreement is drawn up. The client is informed of the approval, and any final documentation or signatures required from the client are obtained. Once this is complete, the loan is considered officially sanctioned.

- PRE DEED

In the PRE DEED stage, the focus shifts to preparing the legal documentation necessary for disbursing the loan. This includes drafting the deed of the loan, ensuring all legal prerequisites are met, and coordinating with legal teams. The aim is to prepare for the finalization of the loan agreement.

DEED

The DEED stage is where the legal documents, including the deed of the loan, are signed and executed. This is the formal conclusion of the loan agreement, making it legally binding. The loan amount is now ready to be disbursed to the client.

POST DEED

Once the deed is executed, the loan enters the POST DEED stage. This phase involves post-disbursement activities such as fund transfer, setting up repayment schedules, and ongoing monitoring of the loan. The bank continues to manage and track the loan until it is fully repaid.

These stages ensure a structured and thorough process for handling loan requests, from the initial preparation to the finalization and beyond.

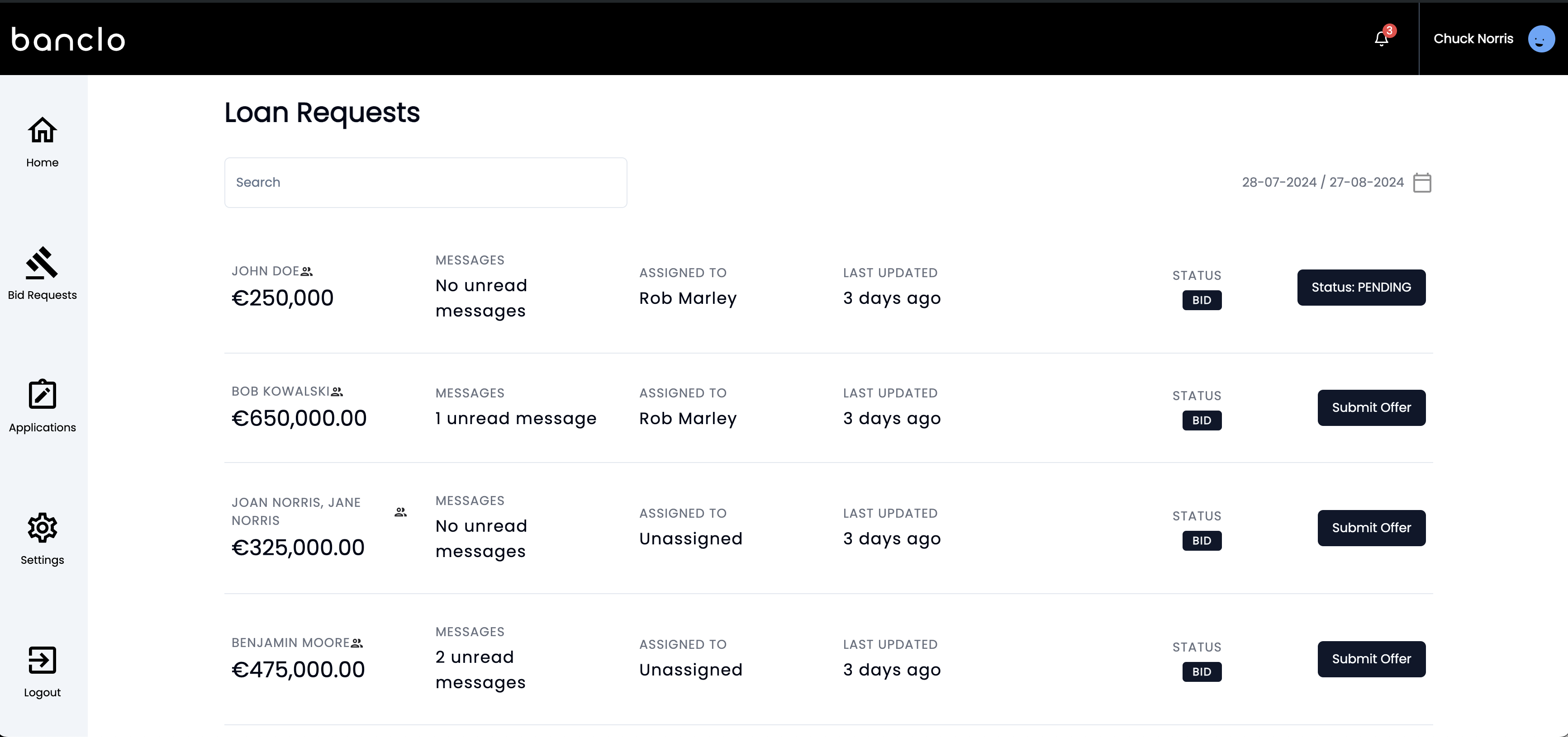

Navigating the Banclo Home Screen

The Banclo home screen provides an overview of all loan request stages.

To focus on either bid requests or active applications, select the appropriate tab—Loan Bids or Applications—from the left-hand menu.

Filtering and Navigation Options

- Search Bar: Quickly locate a specific application using the search functionality.

- Calendar Filter: Use the calendar on the right to filter loan requests by date.

- Pagination: Navigate through multiple pages of loan requests using the pagination controls.

Additional Resources

- Audit Logs - Understanding the complete history and compliance tracking of loan applications

- Assigning Tasks - How to assign and manage tasks within loan applications

- Communication - Managing conversations with clients and team members